Accountants For Startups Tech Startup Accounting No1 Best Startups Accountants UK

Content

- Is accounting service for startups secure?

- How long does it take to get started?

- Posting to Ledger Accounts.

- Types of accounting for startups

- A tech startup accountant who gets taxes

- Our team of industry experts understands your business and are uniquely positioned to provide valuable advice for your startup.

We’ll provide a balance sheet, profit & loss statement and cashflow forecast, plus any metrics that govern performance and commentary, so your leadership team can make informed, risk aware decisions. Our experienced accounting team takes a consultative approach to the year end accounting process.

When you’re first starting, it can be tempting to try to handle everything yourself. In addition, accounting programs can help to improve accuracy and reduce the chances of human error. The EY Startup Solutions Group is one option that small businesses may want to consider.

Is accounting service for startups secure?

As a leading provider of accounting services for startups in India, our experts will always provide highly professional services promptly since we are stringent about meeting all deadlines on time. If you are considering an acquisition or transaction, Azran Financial’s expert startup accountants can assist during the transaction with due diligence and proper tax structuring approaches to ensure your value.

Do I Need A CPA For My Small Business? – Forbes

Do I Need A CPA For My Small Business?.

Posted: Fri, 20 Jan 2023 08:00:00 GMT [source]

VCs and Angels do want to be assured that their accountant for startupss are presented in compliance with GAAP. So, again, you must have as close to GAAP financials as possible. This is as user-friendly and adaptable as possible to suit most SaaS businesses.

How long does it take to get started?

We’re industry experts in new business accounting and are recognised in assisting businesses large and small. We’ve done the rounds a few times here at QAccounting, and have helped start ups understand their accounts and tax obligations for over twenty years. There are numerous duties and responsibilities that come with starting up a successful business, and we will very much hold your hand to help you navigate your way through it all. Sign up below to receive our free eBook on accounting, finance, and tax topics that every startup needs to be aware of to help avoid surprises and headaches down the road. Monthly expenses, tax services, CFO services, and tax preparation are all important factors to consider. These services assist with bookkeeping, financial reporting, and tax compliance. Accrual basis accounting is more complex and takes into account all revenue and expenses regardless of when they are received or paid.

Accounting for startups involves keeping accurate records of financial transactions and examining your finances to identify opportunities for growth and improvement. Outside experience and insight – More than just financial experts, accountants are also trusted advisors. An experienced accountant can provide you with a unique perspective and business acumen to assist you when making important decisions or determining company policies.

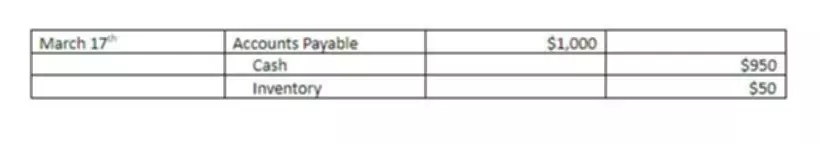

Posting to Ledger Accounts.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here.

https://www.bookstime.com/, resumes, and technical capability may be similar, so find someone that you feel comfortable with. Tax season, two dreaded words for anyone, nevermind for a founder. However, if you are organized from the start, know what documents to have and keep good records, it may not be that bad. You could alwayshand it offto the professional certified public accountants if you just don’t want to deal with it. In the technology and biotech industries, early-stage companies that are playing for the big outcomes need to use GAAP accounting. Many inexpensive, non-CPA bookkeepers will simply do cash based accounting – which is likely fine for a small coffee shop or ad agency.

Types of accounting for startups

Financial protection – From audits to fraud, your start-up business may be vulnerable without an accounting professional. Unfortunately, with every contract, business partner, and client, there is the potential for underhanded business practices.